BTC Highs, Biotech Shake-Up, Rate Cut Update, and Momentum Movers

Weekly Breakdown for the Week of November 11-15, 2024

RFK Jr. Shakes Up Biotech Sentiment

President-elect Donald Trump’s nomination of Robert F. Kennedy Jr. as Secretary of Health and Human Services (HHS) has sparked significant reactions in the financial and political spheres.

Vaccine makers such as Pfizer (PFE), BioNTech (BNTX), and Moderna (MRNA) experienced notable declines in market value following the announcement, reflecting investor concerns over potential regulatory shifts.

Kennedy has outlined plans to overhaul federal health agencies like the FDA, with a focus on increasing transparency, addressing chronic disease, and reducing corporate influence in public health policy.

His nomination has drawn both praise and skepticism. Supporters view it as an opportunity for reform, while others voice concerns over potential disruptions to established health programs.

Kennedy, an environmental lawyer and advocate for public health reform, has emphasized the need for informed consent and transparency in healthcare decisions, as well as a focus on tackling chronic diseases through nutrition and regulatory change.

If confirmed, he would oversee a $1.7 trillion department with broad responsibilities, including drug approvals, pandemic preparedness, and healthcare funding.

While his appointment signals a shift toward reexamining existing health policies, it has also prompted questions about the direction of federal health programs under his leadership.

Tesla Doesn’t Seem to Mind EV Tax Credit Cuts

Elon Musk has expressed support for President-elect Donald Trump’s plan to eliminate the $7,500 federal tax credit for electric vehicle (EV) buyers, a stance that seems counterintuitive given Tesla's (TSLA) position in the EV market.

Removing the tax credit could challenge Tesla’s competitors more than Tesla itself, as the company has already established a strong market lead. Tesla’s dominance, backed by a robust manufacturing infrastructure and competitive pricing, makes it less reliant on subsidies than newer or less profitable rivals.

By ending the tax credit, Tesla could gain further competitive advantages if smaller automakers struggle to sustain growth or scale their operations.

Tesla’s pricing strategy and manufacturing efficiency have enabled it to weather industry changes better than many competitors.

The company has aggressively reduced prices, fueling an EV pricing war while maintaining profitability margins significantly higher than rivals.

Despite potential short-term impacts on demand, analysts argue that Tesla is well-positioned to withstand the loss of the tax credit due to its scale and cost advantages.

Meanwhile, the broader industry, including legacy automakers scaling up domestic production, has lobbied to retain the credit, citing its importance for sustaining the U.S. EV market and manufacturing leadership.

Market Slumps as Fed Becomes Less Eager to Cut Rates

Stock and bond markets declined on Friday after a stronger-than-expected retail sales report suggested the economy remains resilient, potentially reducing the need for further interest rate cuts by the Federal Reserve.

Boston Fed President Susan Collins stated it’s too early to decide on rate cuts for December, emphasizing that additional data on inflation and employment will inform the Fed’s decision.

The Dow fell 300 points, the S&P 500 dropped over 1%, and the Nasdaq lost 2%, while 10-year Treasury yields climbed above 4.5%, reflecting investor uncertainty about the Fed’s path.

Retail sales rose 0.4% in October, beating forecasts, and September’s growth was revised upward, fueling concerns that disinflation progress might be stalling.

Collins and Fed Chair Jerome Powell dismissed the notion of new inflationary pressures, attributing recent price firmness to past economic shocks, such as the lingering effects of earlier car price increases.

The Fed has cut rates twice recently to ease restrictive policy, but expectations for a December cut remain volatile, fluctuating between 60% and 80%. Collins supports continuing gradual rate reductions toward a neutral policy stance, highlighting the lack of fresh inflation drivers and the slow resolution of previous price dynamics.

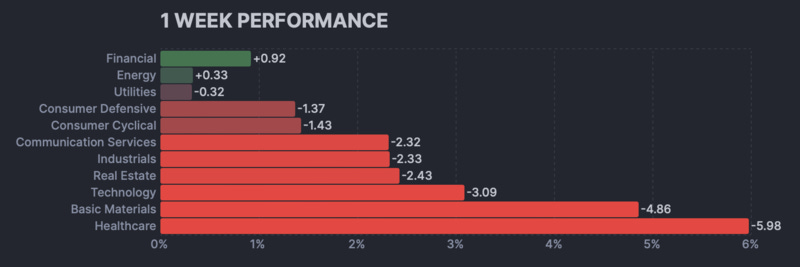

Sector Weekly Performance

Current Themes & Volatile Movers

Crypto Stocks

Bitcoin continued its run from last week and made new all-time highs this week at $93K.

MSTR rose significantly after announcing it bought an additional $2B worth of Bitcoin over the last two weeks.

COIN was up sharply, benefitting from increased crypto trading activity.

MARA, CLSK, and RIOT were volatile as Bitcoin made new all-time highs.

SQ rose 11% after an upgrade from Piper Sandler.

Biotech Movers

Pharma stocks made outsized moves this week, especially to the downside, as government leadership changes created uncertainty around new regulations.

HIMS was down 24% after receiving a downgrade from BofA. Additionally, headlines about Amazon’s low upfront pricing for telehealth and medication plans may have weighed on the stock.

MRNA, PFE, and NVAX were down significantly after RFK Jr. was appointed Secretary of HHS.

AMGN fell 7% after Canter Fitzgerald reported MariTide bone mineral density loss data leaked.

BMY initially rose after ABBV’s Emraclidine drug failed two trials.

EVO was up 12% after it received a proposal to be acquired by Halozyme for $2.1B.

Earnings Reactions

The third-quarter earnings season brought volatility to many individual stocks, with forward guidance being a significant driver of earnings reactions.

AFRM was up 23% after recently reporting quarterly earnings, and positive sentiment in the buy-now-pay-later sector rose in anticipation of Black Friday.

HOOD was up 7% after reporting quarterly financial results and receiving a price target increase from Morgan Stanley.

MNDY fell 15% after financial results and forward guidance did not meet expectations.

SHOP was up 21% after reporting quarterly financial results and receiving several price target increases.

MOS fell 7% after reporting financial results below consensus estimates.

NPWR was up after reporting Q3 operating cash flow of $8M.

PGY was down 35% after reporting Q3 financial results.

RAIL fell 35% after reporting Q3 financial results and guiding FY24 revenue of $560M-$600M.

RKLB rose 28% after reporting financial results, announcing it scheduled its next launch for Kineis, and receiving multiple price target increases.

SOUN was down 17% after reporting financial results and receiving several analyst downgrades.

SPOT was up 11% following the release of its Q3 earnings report and receiving multiple analyst price target increases.

DAVE surged 44% after reporting better-than-expected Q3 EPS and raising its FY24 sales guidance.

PAY was up 27% after reporting strong Q3 revenue and receiving several price target increases.

HNST was up 25% after reporting better-than-expected Q3 sales results and receiving several price target increases.

GRPN was down 27% after reporting worse-than-expected Q3 sales results.

ASTS was down 9% after the company reported worse-than-expected Q3 financial results.

LUNR was up 21% after reporting financial results and receiving several price target increases.

Headline Reactions

News catalysts of all types caused sharp reactions in many stocks this week.

ALT rose 29% after the company said Pemvidutide received a clean safety bill of health from the FDA. Additionally, the company reported financial results, appointed a new CEO, and announced inducement grants under the Nasdaq listing rule.

UPST was down 10% after announcing an offering of $425M of convertible senior notes due 2030.

RIVN announced a joint venture with Volkswagen for a total deal size worth up to $5.8B, but shares fell after news that the Trump administration's plans to cut the EV tax credit surfaced.

SMCI fell sharply after announcing it was unable to file its quarterly report for the period ending Sep 30, 2024, on time.

ALB fell 7% after receiving a price target decrease from KeyBanc.

ZETA was down 37% after a short report from Culper Research titled “Zeta Global Holding Corp: Shams, Scams, and Spam” was released.

GEV fell 7% after the wind industry faced uncertainty following Trump’s election win, according to the NT Times.

EQT rose 6% as natural gas prices surged 10%, possibly in anticipation of US companies gaining energy production market share from foreign competitors.

NEM was down 6% as the price of gold slumped over 2%, continuing a correction in the metal’s price since the US election.

DIS rose 6% after reporting quarterly earnings results, and its CEO Iger said the company is cracking down on password sharing in about 130 countries.

WYNN up 8% after Tilman Fertitta increased his stake in the company.

OMER up 65% after Rodman & Renshaw initiated coverage on the stock with a $9 price target.

ZK down 23% after reporting mixed financial results and announcing it will acquire a 50% stake in LYNK & Co.

PLTR was up 11% Friday after the company announced it would transfer its stock exchange to the Nasdaq.

BE was up 59% after recently announcing a fuel cell deal with AEP, providing clean power for AI data centers. Additionally, Piper Sandler upgraded the stock and raised its price target on it to $19.50.

Market & Economic News

Bitcoin crossed $93K for the first time this week.

Gold fell below $2600 per ounce as its post-election correction continues.

Copper ended the week at nearly $4 per pound as weak Chinese economic data weighed on commodities.

Russia announced it will curb enriched uranium supplies to the US.

The S&P 500 now represents 50% of the value of the global equity market.

Upcoming Earnings

Monday 11/18/24

BTBT, SYM, BTDR, TCOM, BRBR, EH, BRC, TUYA, TWST, ACM, MOND, ZENV, CLRB, NRXP

Tuesday 11/19/24

WMT, POWL, WKHS, AZEK, KEYS, LOW, XPEV, ZTO, MDT, LZB, KORE, FUTU, VIPS, DLB, DNMR, VIK, ATAT, SBLK, QFIN, MYTE

Wednesday 11/20/24

NVDA, NIO, TGT, SNOW, PANW, ZIM, TJX, JACK, WIX, CPA, DY, SQM, WSM, MMS, BERY, CCIF, ESEA, GLBE, RERE, BBAR

Thursday 11/21/24

BIDU, INTU, PDD, ESTC, GAP, DE, BJ, ROST, VSTE, NTAP, WMG, CPRT, BEKE, UGI, IQ, MATW, NNOX, SCVL, NGVC

Friday 11/22/24

GB, ADXN

Upcoming Economic Events & Data

Monday 11/18/24

Fed Goolsbee Speech

NAHB Housing Market Index

Foreign Bond Investment

Tuesday 11/19/24

Building Permits

Housing Starts

API Crude Oil Stock Change

Wednesday 11/20/24

MBA Purchase Index

20-Year Bond Auction

Thursday 11/21/24

Initial Jobless Claims

Philadelphia Fed Manufacturing Index

Continuing Jobless Claims

30-Year Mortgage Rate

10-Year TIPS Auction

Friday 11/22/24

S&P Global Composite PMI

Michigan 5-Year Inflation Expectations

Baker Hughes Rig Count