US Chip Restrictions, Quantum Computing Stocks, and Momentum Movers

Weekly Breakdown for the Week of December 9-13, 2024

US Chip Restrictions Target China

The U.S. is preparing new rules to restrict the sale of advanced AI chips to certain regions, primarily targeting China, in an effort to limit its access to technology that could enhance military and surveillance capabilities.

These restrictions, which build on measures from 2022, aim to cap chip shipments to nations outside close U.S. allies, such as those in Southeast Asia and the Middle East, where chips could potentially be diverted to China. Advanced GPUs, critical for training AI models, are at the center of the curbs, and chipmakers like TSMC and Samsung have been notified to comply.

The measures also include potential controls on the export of AI model weights and tighter restrictions on chip manufacturing technology.

However, the rules risk straining U.S. relations with countries seeking to grow their AI ecosystems, including Malaysia and the UAE. They also complicate business for companies like Nvidia (NVDA), which already faces challenges in navigating existing restrictions.

The new regulations follow U.S. concerns over informal markets, smuggling, and backdoor acquisitions by Chinese entities. They also reflect broader geopolitical tensions exacerbated by China’s retaliatory measures and scrutiny of U.S. partnerships in the Middle East.

Broadcom Surges on Earnings and Guidance

Broadcom's (AVGO) stock surged 24.4% after the company forecasted massive growth in AI chip sales over the next three years, projecting a market opportunity of $60B to $90B by fiscal 2027, compared to $12.2B in AI revenue in 2024.

The company’s projections are driven by demand from hyperscale customers like Google (GOOGL), Meta (META), and ByteDance, with potential upside from new partnerships with Apple (AAPL) and OpenAI.

The company reported strong fiscal Q4 results, with adjusted earnings up 28% and sales up 51% year-over-year, meeting analyst expectations.

Broadcom also forecasted a 65% year-over-year increase in Q1 AI chip sales, contributing to a robust 22% sales growth projection for the quarter.

Analysts responded positively, raising price targets and highlighting Broadcom's innovation, including its upcoming 3-nanometer custom AI chips, which are set to launch in spring and put the company ahead of competitors.

uniQure Jumps on Accelerated FDA Approval Pathway

uniQure’s (QURE) stock soared 109% after announcing alignment with the FDA on an accelerated approval pathway for AMT-130, an investigational one-time gene therapy for Huntington’s disease, a debilitating genetic disorder.

The FDA agreed that existing data from ongoing studies comparing AMT-130 to natural history controls are sufficient for regulatory filing without additional studies, using cUHDRS as a clinical endpoint and cerebrospinal fluid biomarkers like neurofilament light (NfL) as supportive evidence of therapeutic benefit.

Interim data from phase I/II trials demonstrated long-term clinical benefits and reductions in neurodegeneration markers, with AMT-130 showing a manageable safety profile.

uniQure plans to submit a biologics license application in 2025 and will continue dialogue with the FDA. This milestone positions uniQure to advance AMT-130 efficiently while maintaining a robust pipeline, including treatments for epilepsy, ALS, and Fabry disease.

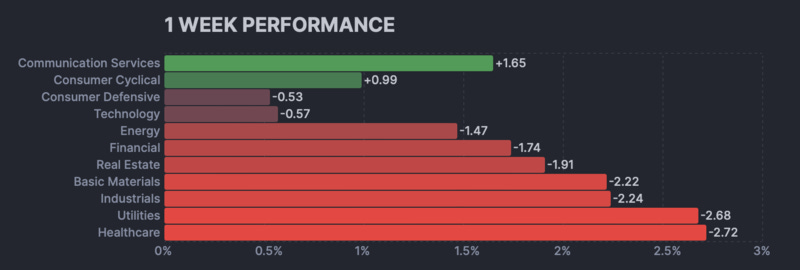

Sector Weekly Performance

Current Themes & Volatile Movers

Chinese Stock Volatility

The recent Chinese Politburo policy meeting stated that further stimulus measures were in the works. China’s focus on boosting domestic demand was emphasized. However, while the stocks in the China sector initially spiked, they almost all retraced their gains as broader concerns about China-US ties persisted.

FUTU started the week up 17%, along with other Chinese stocks such as TIGR, PDD, and BIDU, before retracing the gains later in the week.

Quantum Computing Movers

Quantum computing-themed stocks made outsized moves this week as headlines and sector excitement sparked volatility.

GOOGL up 5% after unveiling its quantum computing chip. The company also released Gemini 2.0 and introduced an AI agent prototype that can browse the web.

RGTI up 40% after it announced a successful AI-powered calibration of a quantum computer with Quantum Machines. The move was associated with heavy volume and option activity. Citron Research posted bearish comments on the stock on Wednesday.

IONQ was volatile this week on no particular news, retracing recent gains from its prior run higher.

ZENA up 28% after the company announced the launch of a quantum computing project for traffic optimization and weather forecasting using its drones.

QBTS up 27% as momentum in the quantum computing space continued after GOOGL recently released its quantum chip.

Biotech Stocks

ANGO up 23% after the company announced that the FDA has granted 510(k) clearance for its Nanoknife system for prostate tissue ablation.

NAMS up 41% after the company announced topline data from its Phase 3 Broadway trial of Obicetrapib.

MRNA down 9% after the FDA highlighted safety challenges and development needs for pediatric RSV vaccines amid historical concerns and recent mRNA trial pauses.

CADL up 68% initially after the company announced results from its Phase 3 clinical trial evaluating CAN-2409 viral immunotherapy in localized prostate cancer patients. It later announced an $80M public offering and the stock retraced its gains.

KROS down 73% after the company announced it halted treatment in the 3.0 mg/kg and 4.5 mg/kg arms of its ongoing TROPOS trial due to safety concerns.

BCYC down 31% after the company announced its lead cancer drug showed a 60% overall response rate combined with Merck’s drug in urothelial cancer patients.

Earnings Reactions

Earnings season brought volatility to many individual stocks, with forward guidance being a significant driver of earnings reactions.

Up on Earnings

CIEN up 15% after the company reported better-than-expected sales results.

RH up 16% after the company raised its guidance and received multiple price target increases.

Down on Earnings

CMCSA down 9% after the company said it expects broadband subscriber losses to be slightly above 100,000 in Q4.

MDB down 16% after reporting financial results and stating that it expects to see a sequential decline in non-Atlas revenue in Q4.

LOVE down 31% after the company reported financial results and lowered its FY25 outlook.

ADBE down 13% after reporting financial results and lowering guidance. The company also received several price target cuts.

PLAY down 20% after the company reported worse-than-expected Q3 EPS and sales. Multiple analysts downgraded the stock following the report.

Headline Reactions

News catalysts of all types caused sharp reactions in many stocks this week.

TMUS down 6% after the company’s CEO advised investors to be “cautious” about Q4 results.

HSY up 10% following a Bloomberg report suggesting Mondelez is exploring a potential acquisition of the company.

WBA up 17% following a report that the company is in talks to sell itself to private equity firm Sycamore Partners.

SMCI down 8% on mounting fears that the company could be removed from the Nasdaq 100.

REAL up 39% after Wells Fargo upgraded the stock and raised its price target.

X down 9% after reports that the Biden administration plans to block the Nippon Steel deal.

BA up 4% following reports suggesting 737 production has resumed.

APP down 14% after the company was not selected to be added to the S&P 500 last week.

OMC down 10% after the company announced it plans to buy Interpublic.

UNH down 5% after suspect Luigi Mangione received sympathy on social media, which is speculated to prompt changes in the company’s business practices.

TSLA up 9% after Goldman Sachs raised its price target on the stock, and it was reported that the company’s sales in China recovered somewhat. The company also announced it is launching its Smart Summon feature in China ahead of the planned FSD rollout in early 2025.

HIMX up 44% after reports stated the company may be an NVDA and TSM supplier.

UBER down 5% after $GM announced it is winding down activities in the robotaxi market.

WBD up 15% after announcing it authorized a new corporate structure comprised of two divisions - “Global Linear Networks & Streaming” and “Streaming & Studios”.

SCHW down 4% after announcing it expects FY24 net revenue to grow by 3%-3.5% vs the prior year.

ACHR up 17% after Canaccord Genuity raised its price target on the stock.

Market & Economic News

Initial jobless claims data rose more than expected.

US PPI data was reported above forecasts.

A 30-year treasury bond auction was met with low demand on Thursday.

The yield on the 10-year treasury rose to 4.4% this week, which is a 5% increase from last week.

CPI met forecasts, showing steady inflation growth.

SpaceX is now the world’s most valuable private startup at $350B valuation.

The WSJ reported that the US tightened AI chip sales rules to curb China’s access.

JPMorgan sees the Fed cutting rates by .25% next week.

China’s credit growth slowed despite stimulus efforts.

Upcoming Earnings

Monday 12/16/24

RCAT, MAMA, QIPT, CMP, RICK, MITK

Tuesday 12/17/24

AMTM, HEI, REE

Wednesday 12/18/24

GIS, MU, ABM, LEN, BIRK, MLKN, TTC, WS, SCS, JBL, OGI, EPAC

Thursday 12/19/24

ACN, NKE, DRI, FDX, CTAS, BB, FDS, AVO, PAYX, SCHL, CAG, KMX, LW, FCEL

Friday 12/20/24

CCL, WGO

Upcoming Economic Events & Data

Monday 12/16/24

NY State Manufacturing Index

S&P Global Composite PMI

S&P Global Services PMI

Tuesday 12/17/24

Retail Sales

Business Inventories

20-Year Bond Auction

Wednesday 12/18/24

Fed Interest Rate Decision

Fed Press Conference

Thursday 12/19/24

GDP Growth Rate

Initial Jobless Claims

Continuing Jobless Claims

PCE / Core PCE Prices

Friday 12/20/24

Core PCE Price Index

Personal Income

Personal Spending

Michigan 5-Year Inflation Expectations